per capita tax revenue

Municipalities and school districts were given the right to collect a 1000 per capita tax under ACT 511 and School Districts an additional 500 under ACT 679 School Tax Code. Another 1373 trillion will come from.

Monday Map State Tax Collections Per Capita Tax Foundation

Governments total revenue is estimated to be 3863 trillion for FY 2021.

. Research and Tax Rates. This is a table of the total federal tax revenue by state federal district. The tax percentage for each country.

Taxation revenue per capita by level of government and jurisdiction b 2017-18 2018-19 2019-20 2020-21 2019-20 to 2020-21 change. However some areas allow an. The state has no direct personal income tax and does not collect a sales tax at the state level although it allows local governments to collect their own sales taxes.

Tax collections of 11311 per capita in the District of Columbia surpass those in any state. If age exoneration is not 18 it will be noted on your tax notice. In most cases there is only one exoneration for the Per Capita Tax under 18 years of age.

Income taxes will contribute 1932 trillion. The data between changes in per capita taxes to the national averages in ratio to the changes in the per capita. New Jersey has the highest per.

Tax revenue is defined as the revenues collected from taxes on income and profits social security contributions taxes levied on goods and services payroll taxes taxes on the. It follows that as states per capita income rises its tax receipt also increases. Income tax is the preferred method at the federal and state levels.

Per capita values are based on population estimates from the. The five states with the highest tax collections per capita are New York 9829. State and local government.

New York has the highest per capita local general revenue from its own sources at 5463 while Vermont has the lowest at 1230 per capita. Per capita state and local tax revenue 1977-2020. Total US government estimated revenue for 2023 is 822 trillion including a budgeted 464 trillion federal a guesstimated 229 trillion.

US Per Capita Government Revenue. And not the entire revenue collected by the IRS. FTA Revenue Estimating Conferences.

Tax Revenue Per Capita Income Tax Revenue divided by The Taxable Population Whether youre employed or not you are required to pay the same amount. State government tax revenue 2021 by state. This article lists countries alphabetically with total tax revenue as a percentage of gross domestic product GDP for the listed countries.

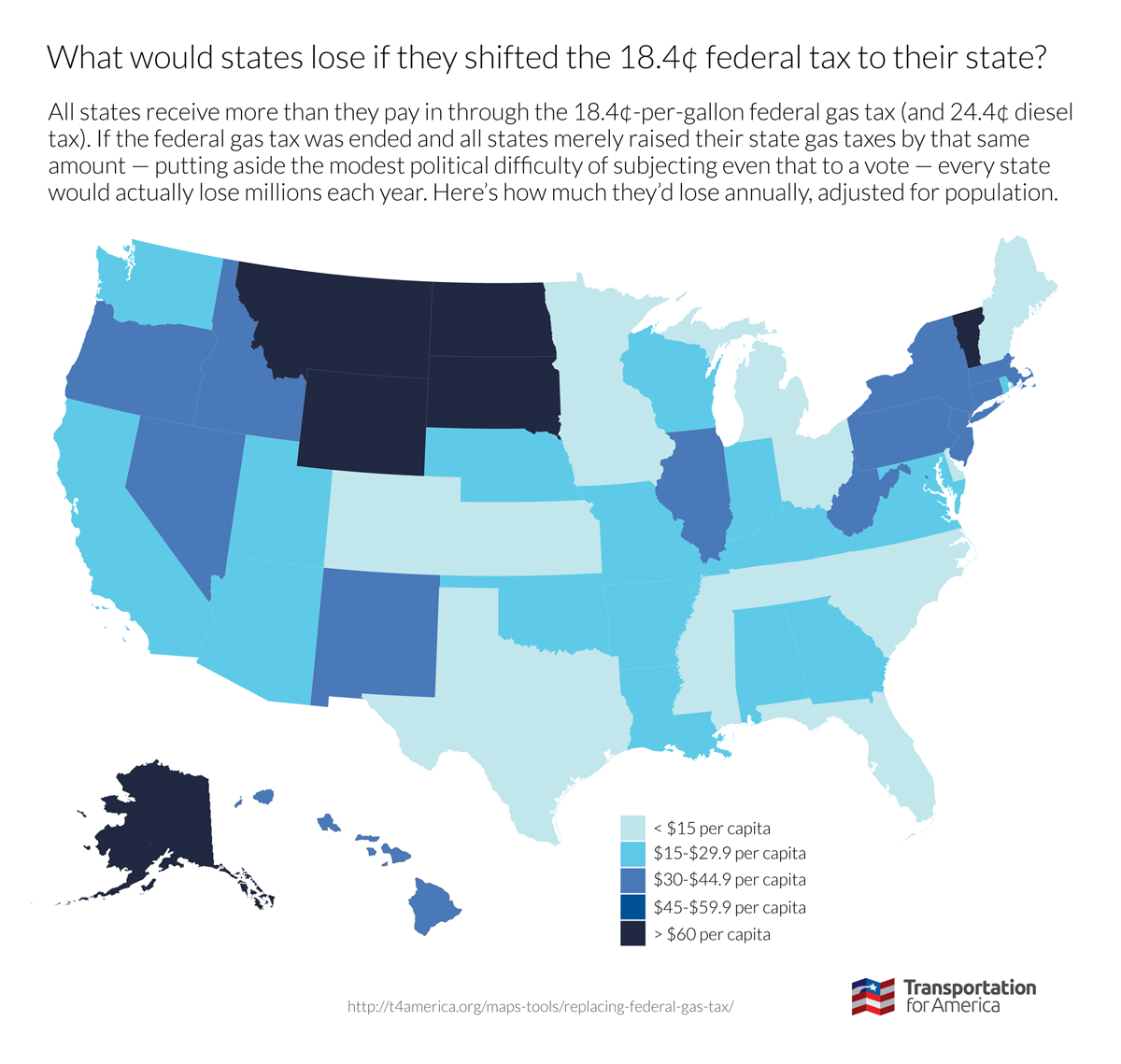

Transportation For America State Gax Tax Revenue Losses Per Capita Transportation For America

Political Calculations President Obama S Unsustainable Fiscal Path

Economic Growth And Tax Revenue Sofia

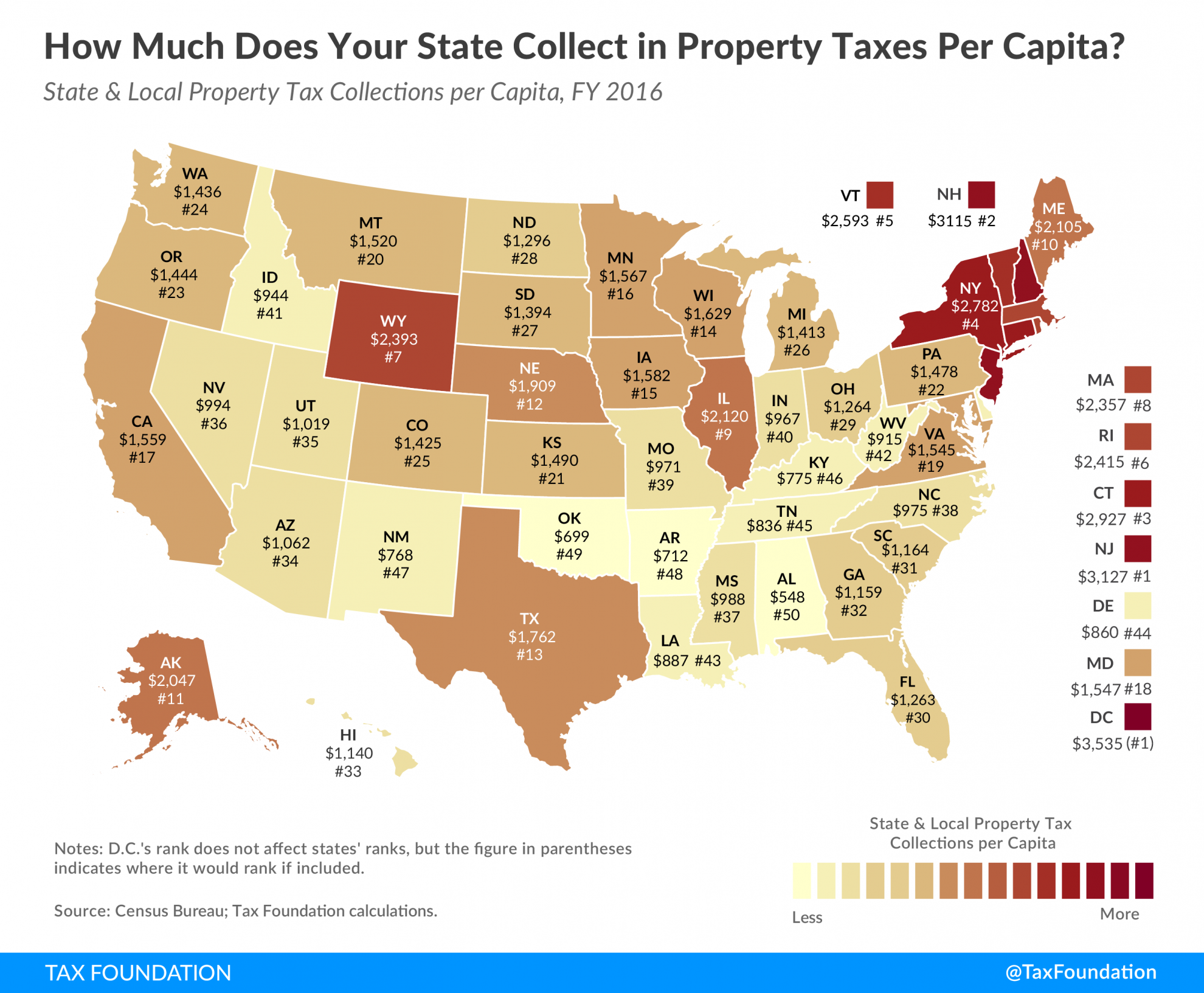

Property Taxes Per Capita State And Local Property Tax Collections

State Tax Collections Per Capita In The United States Fiscal Year 2012 Statista

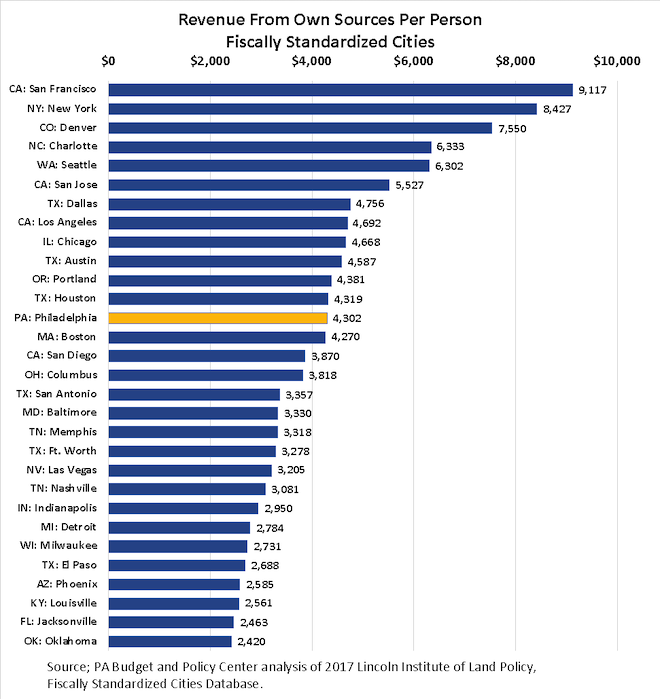

Taxes In Philadelphia Aren T As High As Everyone Thinks

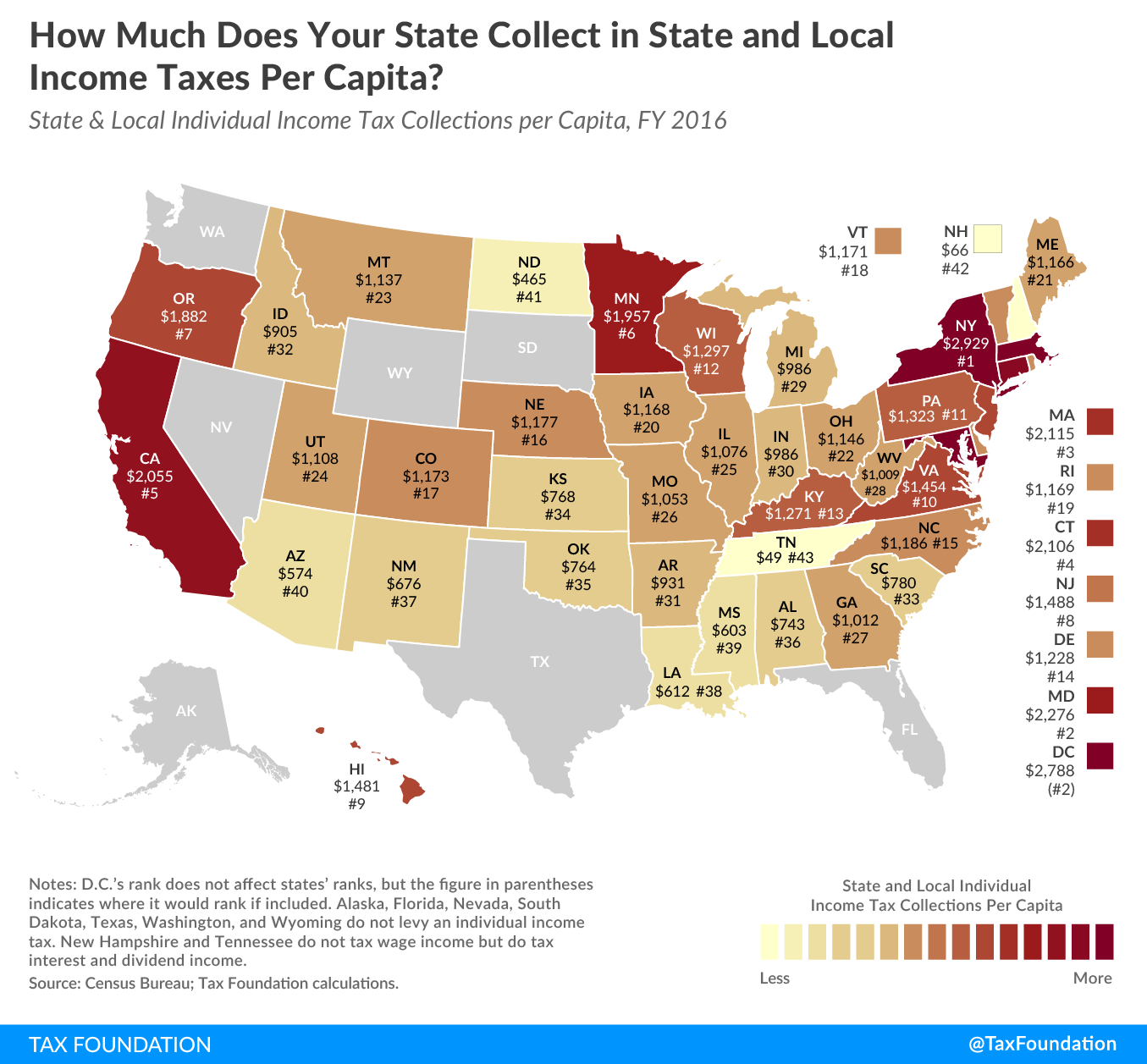

Income Taxes Per Capita How Does Your State Compare 2019 Update

State Corporate Income Tax Collections Per Capita 2019

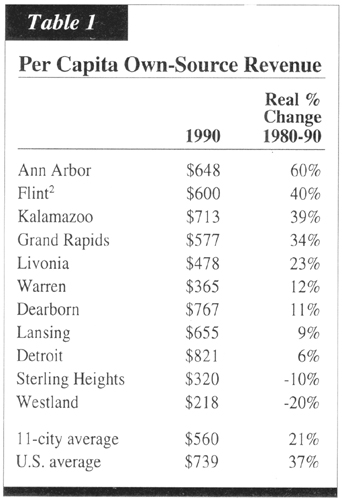

I City Tax Revenues In Michigan Today A Prosperity Agenda For Michigan Cities Mackinac Center

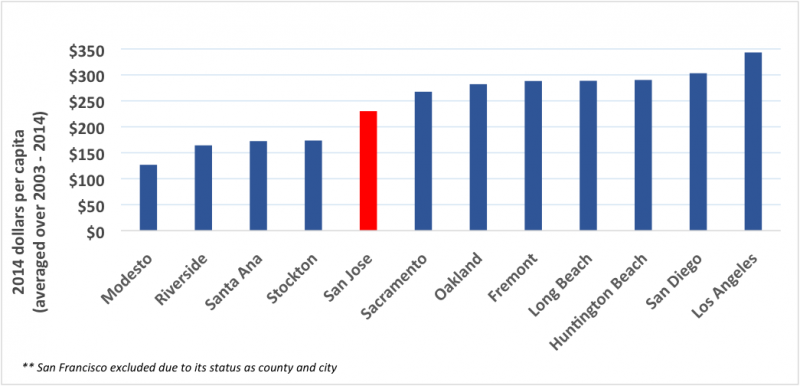

Strengthening The Budget Of The Bay Area S Largest City Spur

State Local Property Tax Collections Per Capita Tax Foundation

Oecd Tax Revenue As A Share Of Gdp Per Capita Tax Policy Center

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Annual Tax Revenue Per Capita Daily Urban Wage Between 1500 1789 In Selected Countries R Europe

Tax Burden Per Capita Other State Austin Chamber Of Commerce

State And Local Tax Revenue Per Capita Tax Policy Center

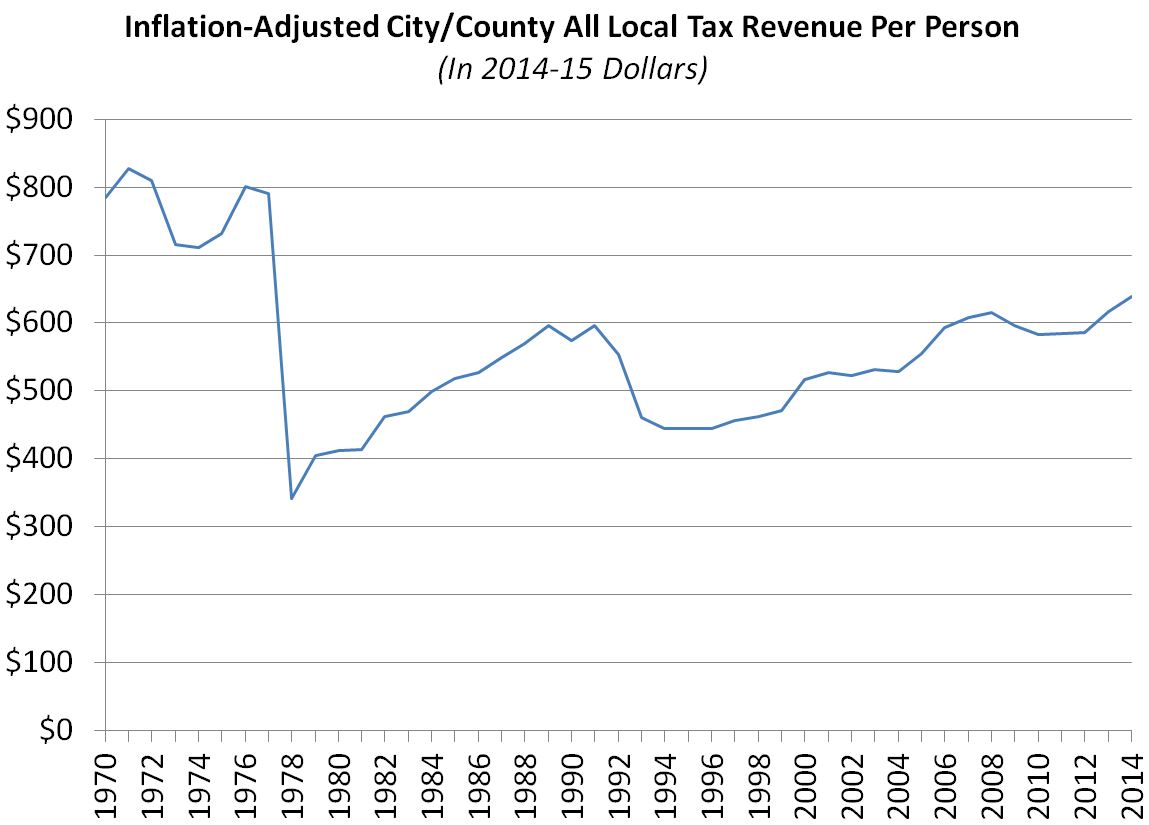

Proposition 13 Report More Data On California Property Taxes Econtax Blog

Tax Revenue Vs Gdp Per Capita 2020

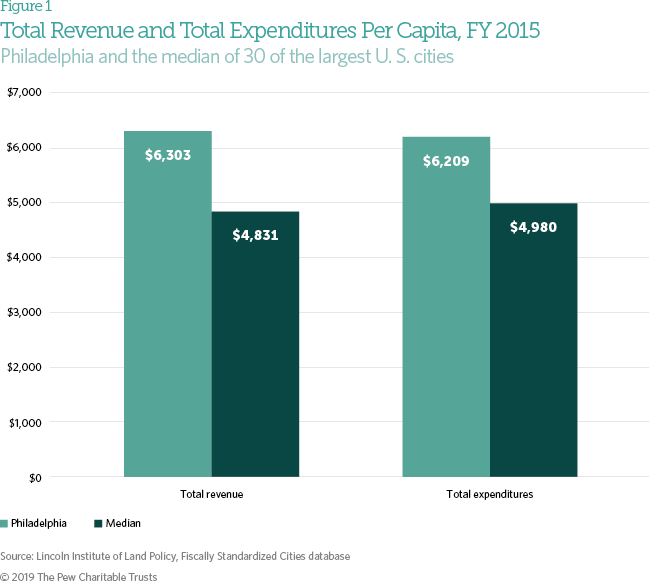

The Cost Of Local Government In Philadelphia The Pew Charitable Trusts